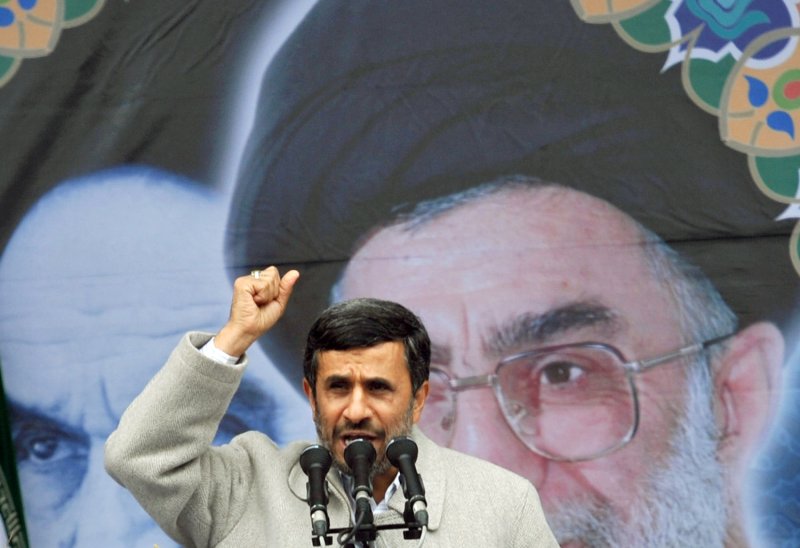

Iranian President Mahmoud Ahmadinejad speaks in front of the pictures of Iran's late leader Ayatolah Khomeini (L) and Iran's current Leader Ayatolah Khamenei during the 32nd anniversary of the Islamic Revolution in Tehran, Iran on February 11, 2011. UPI/Maryam Rahmanian. |

License Photo

DUBAI, United Arab Emirates, March 9 (UPI) -- There are growing concerns that Iran is seeking to exploit the political turmoil swirling through the Arab world.

That, analysts say, puts at risk Saudi Arabia, Kuwait and Iraq, three key oil producers that have fields and export terminals in or near areas where Shiite Muslims predominate.

Libya's oil production has been reduced by around 75 percent as the country slides into all-out civil war, with rebels fighting Moammar Gadhafi's beleaguered regime holding the eastern oil fields and export terminals.

The country normally produces 1.6 million barrels per day, 1.1 million bpd for export.

All the foreign companies that ran Libya's oil industry have fled and production is likely to dwindle further without their expertise. With Oman, Algeria and Yemen facing growing unrest, it's possible that global output could fall further.

"Our concern is that the Iranians will take advantage of the situation, this new-found obsession with protests, to encourage Shiite minorities throughout the entire western rim of the Persian Gulf to rebel against their (Sunni) political masters," observed Peter Zeihan, vice president of analysis at the global security consultancy Stratfor.

He identified three key producing basins where Shiites form the majority population – Ramailah in southern Iraq, the Bergen field in southern Kuwait and the giant Ghawar field in eastern Saudi Arabia, the largest in the world.

"To this point," Zeihan said, "there has not been a single documented case of protesters attacking a piece of energy infrastructure anywhere in North Africa or the wider Middle East.

"But the rules of the game have changed. We're now less concerned about popular protest than we are about the Iranians instigating events. Taking out an oil competitor is a perfectly legitimate course of action from their point of view.

"And in this case, we've got roughly 10 million bpd at potential risk."

With Libyan production way down, Saudi Arabia says it has picked up the slack, as it did in 2008 when oil prices spiked at $147 per barrel, by using its declared spare production capacity of some 5 million bpd, on top of its normal output of around 8.5 million bpd.

But there are widespread concerns in the market that Aramco, Saudi Arabia's state oil corporation, doesn't have the ability to make up any major shortfall.

"Riyadh has yet to provide details of how much it is pumping right now, a critical question as oil prices races toward $120 a barrel," the Financial Times commented Tuesday.

In 2008, the Saudis pumped nearly 2.5 million barrels a day over their normal output. Some industry estimates put Saudi Arabia's true spare capacity at 3 million-3.5 million bpd.

"Though the rich world's inventories are high, with cover for around 50 days, it is not clear that Saudi Arabia can pump much more than it did in 2008," The Economist cautioned.

"If disturbances hit Algeria and threaten its oil industry too, the buffer of spare capacity would fall below where it stood in 2008. But demand now is much higher, so spare capacity as a proportion of that demand is much lower …

"When oil markets operate to the limits of supply, even the smallest extra disruption has a disproportionate effect."

Multiple bombings knocked out Iraq's largest refinery at Baiji, north of Baghdad, Feb. 26, slashing production by 150,000 bpd.

Although that wasn't linked directly to the political unrest roiling the Arab world, in the current crisis that kind of attack could knock out 500,000 bpd from global oil supplies and cause severe disruption.

And such attacks need not be confined to the Middle East.

"If the raids on oil installations in previous elections in Nigeria are anything to go by, the next one, in April, may threaten another 1 million bpd of supplies from West Africa," The Economist cautioned.

Even if the Saudis can fill the gap, there are worries that it won't be producing the kind of oil its customers want.

Global demand is for light, sweet crude, which is cheaper to refine and which most refineries around the world are geared to handle.

Saudi oil is generally heavier and more sulfurous than the lighter Libyan crude it would be replacing, so prices will likely remain high.