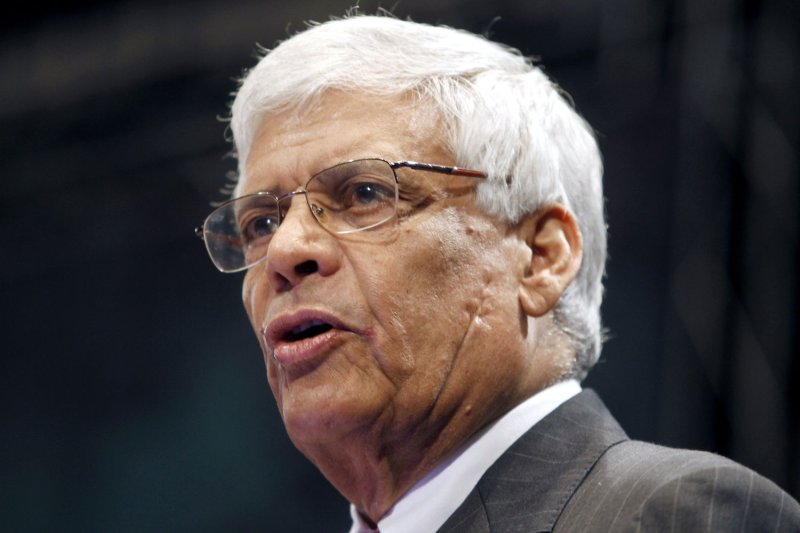

1 of 3 | Secretary General of OPEC Abdalla Salem El Badri, delivers remarks during a ceremony to mark the 50th anniversary of the establishment of the Organization of Petroleum Exporting Countries (OPEC) in Tehran, Iran on April 19,2011. UPI/Maryam Rahmanian |

License Photo

RIYADH, Saudi Arabia, June 15 (UPI) -- The failure of OPEC, which controls 40 percent of the global oil supply, to boost production at its recent Vienna meeting has raised concerns Saudi Arabia is losing its traditional clout at a time when it is increasingly locked in a cold war with Iran.

Saudi efforts to have the Organization of Petroleum Exporting Countries hike its output to curb rising prices were defeated by Iran and Venezuela, both price hawks in the 12-member cartel.

That result at the June 8 meeting pointed to a shift of power within OPEC away from Saudi Arabia, which has long dominated the 50-year-old organization.

Javier Blas, the Financial Times commodities expert, says the alarm about Riyadh's clout following the Vienna meeting may be exaggerated.

"To describe the outcome as a defeat for Saudi Arabia could be misleading," he observed. "Saudi Arabia is likely to have the last word, on both prices and supplies, rather than Venezuela and Iran …

"The disarray at the meeting also in effect buried the production quota system that has governed the official output level at OPEC since 1986. That gives Saudi Arabia a green light to produce as much oil as it likes."

Riyadh quietly increased its production after Vienna, going from around 8.5 million barrels per day to more than 9 million bpd for the first time since 2008.

Industry analysts say the kingdom could be pumping as much as 10 million bpd by the third quarter, with Saudi allies Kuwait, the United Arab Emirates and Qatar boosting production as well.

But regional turbulence that is creating far-reaching changes in the geopolitical landscape is increasingly intruding on the energy issue at a time when the world's oil reserves are moving into decline.

Saudi Arabia, the world's leading producer and which sits on 12 percent of known global oil reserves, is struggling to shield itself from the political turmoil that has been engulfing the Arab world since January.

Energy analysts are concerned that Riyadh is using its vast oil wealth to buy U.S. weapons systems worth $67 billion to confront an expansionist Iran and spend another $130 billion on buying off the Saudi population to prevent internal unrest, rather than invest hundreds of billions of dollars in developing new oil reserves.

The Saudis earned around $214 billion from oil exports in 2010. That's expected to hit $300 billion this year. So it's not like they don't have the money.

But, says U.S. analyst Michael T. Klare, "when it comes to the future availability of oil, it is impossible to overstate the importance of this spring's events in the Middle East, which continue to thoroughly rattle the energy markets."

In a June 6 analysis published by Middle East Online, Klare observed: "According to all projections of global petroleum output, Saudi Arabia and the other Persian Gulf states are slated to supply an ever-increasing share of the world's total oil supply as production in key regions elsewhere declines.

"Achieving this production increase is essential but it will not happen unless the rulers of those countries invest colossal sums in the development of new petroleum reserves -- especially the heavy 'tough oil' variety that requires far more costly infrastructure than existing 'easy oil' deposits."

The Wall Street Journal reported recently that any hope of producing the amounts of oil the world will require in the future rests on a Saudi willingness to invest hundreds of billions of dollars into their heavy-oil reserves.

"But right now, "Klare noted, "faced with a ballooning population and the prospect of an Egyptian-style youth revolt, the Saudi leadership seems intent on using its staggering wealth on employment-generating public works programs and vast arrays of weaponry, not new tough-oil facilities.

"The same is largely true of the other monarchial oil states of the Persian Gulf," said Klare, who has written extensively on the conflicts that lie ahead as the planet's resources shrink.

"If something happens in Saudi Arabia, oil will go to $200 or $300 per barrel," Sheik Zaki Yamani, the kingdom's oil minister in 1962-86 and a key figure in OPEC's development, warned in April.

"I don't expect that for the time being but who would have expected Tunisia?"