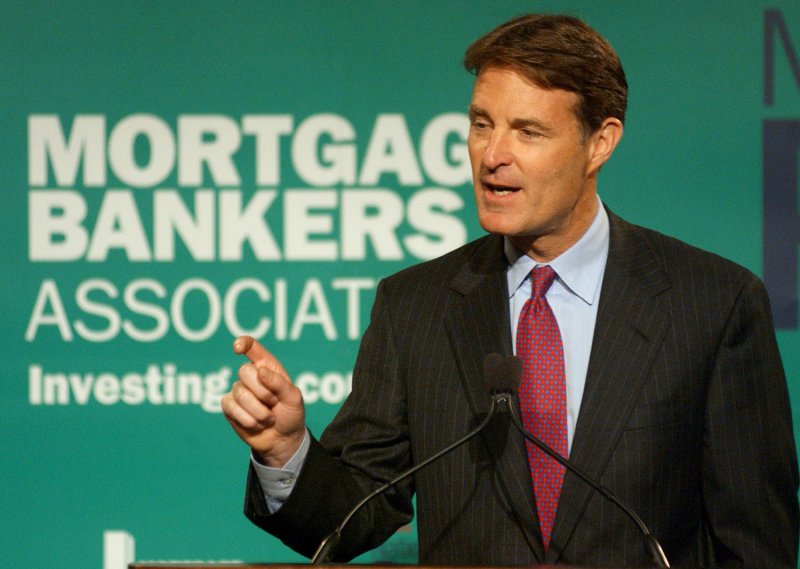

Sen. Evan Bayh, D-Ind. speaks to the Mortgage Bankers Association about US economic and housing policies during the Association's 2005 National Policy Conference in Washington on April 19, 2005. (UPI Photo/Roger L. Wollenberg) |

License Photo

WASHINGTON, April 23 (UPI) -- The flood of U.S. homeowners needing help and homeowners disconnected from services are frustrating lenders, officials said Tuesday.

A coalition of bankers and state attorneys general released a report that said 70 percent of troubled homeowners had no plan for turning their troubles around, The Washington Post reported Wednesday.

"There still seems to be a disconnect between homeowners and their mortgage servicers," Mark Pearce, deputy commissioner of banks for North Carolina told the Post.

At the same time, the study found lenders' workloads are increasing. More than 50,000 additional loans received help in January than they did in October of 2007, Pearce told the Post. But 90,000 more loans were declared delinquent during that time, he said.

The coalition called for a system-wide change so that loan modifications could be processed faster.

Almost two-thirds of the loans under consideration for modifications between October and January took more than one month to process, the report said.

Iowa Attorney General Tom Miller called for a shift in how lenders think.

As lenders wrestle with the notion of lowering monthly payments or reducing principal, "a shift in psychology needs to be made," Miller told the Post.