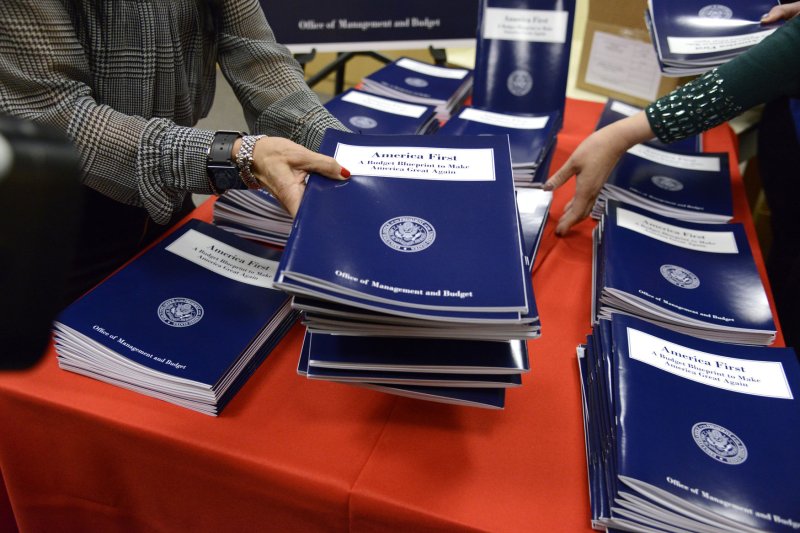

Government Printing Office staff distribute copies of the Fiscal Year 2018 Budget at the GPO bookstore on Thursday in Washington. Photo by Mike Theiler/UPI | License PhotoPhoto by Mike Theiler/UPI |

License Photo

March 30 (UPI) -- The Congressional Budget Office projects the U.S. debt will more than triple over the next 30 years to a record 150 percent of the gross domestic product, the nonpartisan office said in a report Thursday.

Last year the CBO predicted the debt would grow to 141 percent by 2046. The record was 106 percent in 1946 after World War II.

"The prospect of such large and growing debt poses substantial risks for the nation and presents policymakers with significant challenges," the report said.

The CBO projects the $14.3 trillion debt now held by the public will be 77 percent of GDP this year and increase to 89 percent of GDP in 2027 and 113 percent in 2037.

This year the annual deficit, which is the difference between the government's yearly revenues and expenditures, is expected to reached 2.9 percent of GDP. It will grow to 4 percent between 2018 and 2027 and to 8.6 percent between 2038 and 2047. Last year's deficit was $587 billion, CNBC reported.

Net interest costs will amount to 21 percent of total federal spending by 2047, up from 7 percent today and 10 percent over the past 50 years, the CBO said.

The CBO estimates most of the added spending will come from Social Security and Medicare benefits from the aging population.

Social Security and the major healthcare programs constitute 54 percent of all federal noninterest spending, more than the average of 37 percent over the past 50 years. That figure would increase to 67 percent by 2047, the CBO projects.

The estimates are based upon the continuation of the Affordable Care Act, commonly known as Obamacare. House Republicans failed to repeal and replace it last Friday.

"Large and growing federal debt over the coming decades would hurt the economy and constrain future budget policy," the analysts wrote. "The amount of debt that is projected under the extended baseline would reduce national saving and income in the long term; increase the government's interest costs, putting more pressure on the rest of the budget; limit lawmakers' ability to respond to unforeseen events; and increase the likelihood of a fiscal crisis."

The House and Senate have until April 28 to reach agreement on a spending package to prevent a government shutdown when funding runs out.

President Donald Trump's proposed budget released on March 16 seeks cuts in several agencies but a $52.3 billion increase in the Defense Department.